Background

About Eigenlayer

EigenLayer is a protocol built on Ethereum that introduces restaking, a new primitive in pooled cryptoeconomic security. This allows for the rehypothecation of Ethereum on the consensus layer and creates the first iteration of an on-chain decentralized trust and security validating mechanism.

Restaking

Restaking lets users allocate their ETH/LST to support validation across various networks at once, including Ethereum and others integrated with a restaking protocol. By leveraging Ethereum’s security framework, it enhances capital effectiveness, offering stakers extra rewards for their validation efforts.

Restaking Avantages

- Protocols Economic Security: Establishing economic security for new protocols is challenging. EigenLayer offers developers an affordable option to achieve this.

- Protocol Flexibility: While focusing on application-specific decisions, protocols can still maintain full control over consensus and penalty terms.

- Enhanced Capital Efficiency: Through restaking, stakers can earn extra rewards from validating various services without committing extra funds, optimizing their capital use, and increasing their validation-related earnings.

Restaking Challenges

- Smart Contract Risk: EigenLayer enforces slashing by obtaining the withdrawal credential rights to the staked ETH via an EigenLayer smart contract — opening up a potential attack vector where an improper contract implementation could result in stakers losing their ETH collateral.

- Rehypothecation Risk: As restaked ETH can be “rehypothecated” to secure multiple protocols simultaneously, the failure of one or more validators could potentially affect the entire ecosystem of protocols using EigenLayer’s pooled security.

- Underwriting Risk: Any protocol can use EigenLayer to buy pooled security from validators, with validators being able to selectively choose which protocols to extend security to. Validators will need to perform due diligence on which protocols to validate, as there is a risk that the restaked ETH could be slashed by malicious protocols.

- Malicious Validator Risk: Malicious validators could collude to form a majority, potentially putting a protocol’s security at risk.

LST Restaking

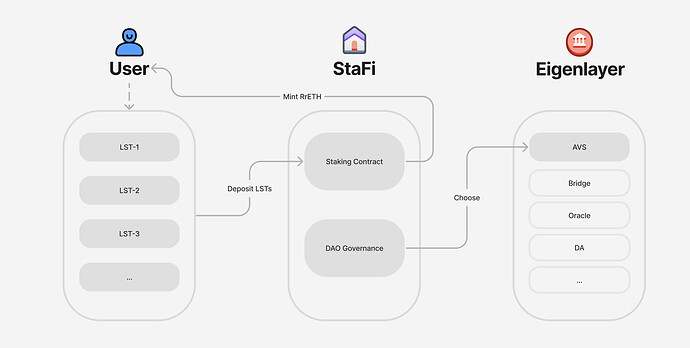

Users will be able to redelegate their LST into StaFi, those LST need to be supported by Eigenlayer. By doing this, user will receive a tokenised version of restaked Ethereum. It is a non-rebasing, yield bearing token that allows holders to earn EigenLayer native rewards. By depositing LSTs into StaFi, users will receive an equivalent amount of RrETH.

Holding RrETH guarantees seamlessly earning Ethereum’s staking rewards (estimated to vary between 3%-5%) and also EigenLayer rewards on top (estimated at 10%+).

It will be fully liquid, tradeable on DEXs and will be integrated in DeFi protocols.

Delegation

Pooled LSTs are split up and transferred to multiple StaFi Delegator smart contracts, ready to be restaked on EigenLayer. The number of Delegators and amount of LSTs held by each are determined by governance.

For each Delegator smart contract, StaFi governance will monitor the performance and choose an Operator on EigenLayer to restake and delegate to. This process of delegating across multiple Operators provides diversification to StaFi restakers and reduces the risk of a single bad or malicious Operator being slashed. Governance can also choose to unstake and get back the LSTs from a poor performing Operator, or when there are pending withdrawal requests from users.

Rewards

Rewards received from our Operators performing tasks for AVSs on EigenLayer are swapped to supported LSTs (currently stETH, rETH, cbETH) and deposited back to the StaFi restaking pool smart contract. This allows rewards earned to be compounded (restaked back to EigenLayer), benefiting StaFi restakers.

Hence, RrETH APR = LST APR + EigenLayer restaking APR.

Withdraw

Users can request to withdraw their LST from the restaking pool. When requesting to withdraw back 1 LST, corresponding amount of RrETH (according to the on-chain exchange rate) from the user’s balance will be transferred to the restaking pool to be “locked” and the user’s withdrawal request will be put in a queue for processing.

Requests in the queue are processed sequentially (first come first served). According to the Eigenlayer, EigenLayer is launching with a maximally conservative withdrawal delay, which is intended to only decrease over time. A 7-day delay window should give ample time to review withdrawals for anything suspicious and pause relevant functionality if needed.

For instant liquidity, StaFi will also provide LRT liquidity pools on Dexes, combine with liquidity mining programs.

What’s Next

We are excited to announce that we are proposing a new product that will allow users to restake their LST on EigenLayer. EigenLayer is a protocol that enables new applications and services to be built on top of Ethereum while also improving the security and efficiency of the network. By restaking their LSTs on EigenLayer, StaFi community members will be able to support the growth of the Ethereum ecosystem and earn additional rewards.

Beside the RrETH restaking proposal, we also proposed StaFi rETH restaking proposal in Eigenlayer community forum at June 22th, once this proposal is approved by the community, we will both provide LST restaking service and its redeposit service, we expect to launch the StaFi EigenLayer restaking product in 2024.

We are currently in the process of gathering feedback from the community on this proposal. A series of community discussions and polls will be hold to gauge interest and gather suggestions. We encourage you to participate in these discussions and share your thoughts on the proposal.