Overview

As StaFi’s diverse product offerings continue to evolve and improve, so too has our Validator ecosystem. StaFi’s Validator ecosystem, primarily composed of StaFi Chain Validators, StaFiHub Validators, and rToken Validators, plays a vital role in our framework. They verify a myriad of transactions in the StaFi ecosystem, thus ensuring its security and stability, and in return, receive their corresponding rewards.

However, as the architectural landscape of our products undergoes constant adjustments, the security requirements for the underlying chain inevitably change as well. Recognizing this, the StaFi Foundation finds it essential to highlight the differences and roles of the various types of StaFi Validator in our ecosystem. Additionally, we’re taking steps to publicize our long-term Validator recruitment plan to the wider Web3 community.

StaFi Chain Validators

Except for rETH, all StaFi LSTs (Liquid Staking Tokens) are directly issued on the StaFi Chain. With the escalating growth of TVL (Total Value Locked), the security demands for the StaFi Chain have increased substantially. To mitigate the risks related, we have incorporated an EVM-compatible solution into StaFi LSTs, thereby bolstering their security by delegating security of rToken assets to their respective Target Chains. However, it’s important to note that this does not compromise our security standards for the StaFi Chain.

At present, we have 160 selected validators and another 57 on the waiting list on the StaFi Chain Mainnet. To maintain a dynamic and decentralized network, we plan to continuously recruit StaFi Chain validators for the long term. We will outline the recruitment rules in subsequent sections. Simultaneously, to keep our community informed, the StaFi Foundation will regularly assess and report on the mainnet status of StaFi and its validators, ensuring updates are promptly shared with our community.

StaFiHub Validators

Presently, StaFiHub operates on a BPoS consensus mechanism and is overseen by 15 trusted validators, with no provisions for public staking. An issue arises when the asset value staked on StaFiHub surpasses the FIS Staking Value, which could potentially incentivize attackers to destabilize the network. These malicious actors might attempt to control the network by staking more FIS tokens than the current validators, aiming to expropriate the assets locked within the StaFiHub contract.

To mitigate this risk, StaFiHub plans to incorporate Interchain Security (ICS) from Cosmos Hub . This will enable us to leverage the security infrastructure of the Cosmos chain, thus augmenting our own network’s security and decentralization. This move is geared towards ensuring the utmost safety for stakeholders within the StaFiHub network.

In this revamped model, the existing validators of StaFiHub will be subject to reconsideration once the Interchain Security has been implemented. For more detailed information, please refer to our proposal on integrating ICS into StaFiHub .

rToken Validators

A rToken Validator refers best performing validators chosen by StaFi using our Delegation Algorithm , which takes into account tokens (including ATOM, IRIS, HUAHUA, SWTH, MATIC, SOL, BNB, DOT, KSM) deposited by users. These validators play a key role in helping users maximize their profits and mitigate potential losses.

Beyond optimizing staking rewards and minimizing losses for stakers, our Delegation Algorithm serves a crucial function in decentralizing delegations and preventing the concentration of voting power among validators on the target chains. During the selection process, the algorithm automatically filters out validators with slash records and ranks the remaining ones. To avoid centralization, validators positioned at the top and bottom of the ranking spectrum are eliminated. The algorithm then scrutinizes the staking rewards of the surviving validators to identify those yielding higher returns for delegation. This process is further supported by temporary and regular rotation mechanisms, which complement the Delegation Algorithm to ensure only the best validators are selected.

Taking into account the fluctuating performance of validators and real-time network conditions, we remain committed to optimizing the StaFi delegation algorithm to build a decentralized, intelligent delegation algorithm capable of assisting users generate the best staking returns, while also fostering more decentralized voting on the target chains.

As for the more unique rETH, validators have the opportunity to operate an Ethereum node through StaFi rETH. In our ongoing efforts to bolster the overall security of our protocol and safeguard StaFi stakers, we’ve increased the validator threshold from 4 ETH to 12 ETH. Validators who choose to run an Ethereum node via StaFi will receive an allocation of 20 ETH provided by StaFi. Current data from the StaFi rETH Pool page shows that there are 457 validators presently operating an Ethereum node through StaFi, with a surplus unmatched amount of 248 ETH. This clearly indicates the availability of sufficient ETH for allocation to validators.

Validator Long-Term Recruitment Plan

The continuous addition of validators to the StaFi ecosystem serves as the cornerstone of StaFi network security and decentralization. Therefore, we are opening up validator positions on a long-term basis. Since validators will be phased out once StaFiHub implements Interchain Security (ICS), this long-term validator recruitment plan is solely applicable to StaFi Chain and StaFi rETH. Given the differences in admission mechanisms for the two types of validators, we have distinct recruitment rules for each validator type.

Recruitment of StaFi Chain Validators

StaFi Foundation will use direct invitations, community applications and grant the validators in the waiting list to optimize the current StaFi validator ecosystem.

1.Invitations

The StaFi Foundation will proactively extend invitations to prominent institutional validators to operate nodes on the StaFi chain. These institutions should be highly popular and serve as crucial partners within the StaFi ecosystem.

2.Select the validators from waiting list

The majority of validators on the waiting list are individual developers. To enhance decentralization on the StaFi Chain mainnet, we aim to nominate select promising validators from this list.

Ideal validator candidates should fulfill the following criteria:

-

Commission: The commission is capped at below 10%, aligning with the StaFi Foundation’s standards for validators on the StaFi Chain mainnet.

-

Number of nominators: A larger number of nominators typically indicates a validator’s greater influence within the community. The specific number of nominators required depends on the existing count for each validator on the waiting list.

-

Amount of self-bound assets: The StaFi Foundation favors validators who have committed a substantial amount of self-bound assets, as this tends to reflect the comprehensive strength of the validator to some extent.

3.Community Application

StaFi Validator Program will also open applications to the community, and any professional validator will be able to apply.

The StaFi Foundation will assess applications comprehensively, considering contributions made to the StaFi rToken ecosystem. Applicants who have significantly contributed to the development of the StaFi ecosystem will be given priority.

Qualified validators will be granted a nomination, which lasts for a three-month period. As standard practice, we issue a reminder in the last month of every quarter for validators to submit their contributions. Selection outcomes will be announced at the start of the first month of the succeeding quarter. For real-time updates, stay tuned to the StaFi Discord.

StaFi rETH Validator Requirements

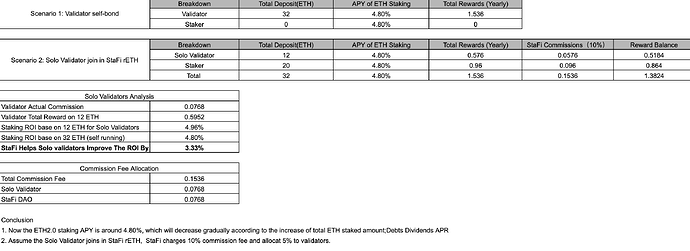

To operate an Ethereum node through StaFi, validators are required to deposit only 12 ETH. Our calculations indicate that compared to running a node directly on the Ethereum mainnet with a deposit of 32 ETH, operating a node through StaFi yields a significantly higher return – an increase of 3.33%.

Application: https://app.stafi.io/validator/reth/choose-validator

Guide: https://docs.stafi.io/rtoken-app/reth-solution/original-validator-guide

We extend a warm welcome to all validators interested in joining the StaFi ecosystem. We remain committed to the continual optimization of the delegation algorithm and to updating the validator selection criteria in response to network conditions. Your suggestions and feedback are highly valuable, and we encourage you to share your thoughts on the StaFi forum!