We are currently developing a Liquid Restaking Token (LRT) stack tailored for developers, alongside conducting a comprehensive due diligence on restaking protocols such as Eigenlayer and Karak. Here’s a brief overview based on our research findings.

The Story of Shared Security

Restaking protocols provide an economic security of DApps and appchains by leveraging the collective value of staked assets within a pool contract. This concept isn’t entirely new; pioneer like Polkadot introduced the idea of shared security back in 2018, and its learner Cosmos, has its version of shared security in 2023. The term “restaking” originates from ETH staking in Ethereum, a process that Eigenlayer has expanded upon, allowing staked ETH to be re-staked to a pool contract to verify either a DApp or an entire blockchain.

Fundamentally, restaking mimics the construction of a Proof of Stake (PoS) system, akin to layer 1 PoS blockchains, to safeguard DApps or chains. It establishes a marketplace linking stakers and validators (or operators), transitioning traditional staking into restaking. However, a significant departure lies in the source of security: it’s derived from the external valuation of the staked assets rather than the internal security provided by native tokens. For instance, in Polkadot’s ecosystem, the Polkadot blockchain is secured internally by its native staking token, DOT, with stakers earning rewards from DOT inflation. Simultaneously, its parachains enjoy shared security, backed externally by staked DOT via crowdloans, with incentives provided by the native tokens of the parachains.

Key Differences Between the Players

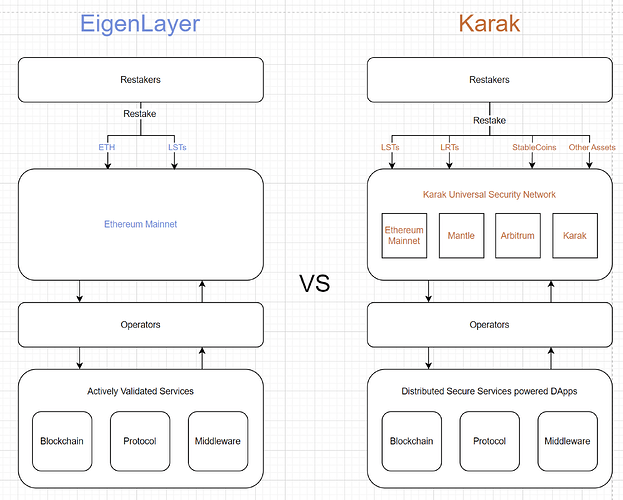

Currently, we are monitoring two major Ethereum-based entities in the restaking space. The first, Eigenlayer (EL), is an established giant, while the second, Karak, has recently emerged, drawing significant attention with substantial tier-one institutional investment. As the pioneer of restaking, EL has been refining its model for nearly a year. In contrast, Karak is a newcomer, introducing unique features that set it apart from EL. The primary distinctions between them lie in the types of assets and networks they support, with the choice of supported networks largely influenced by the assets they handle.

Assets Supported by Karak:

- ETH, LST, LRT, Stablecoins, LP Tokens, and Wrapped Bitcoin, etc.

Assets Supported by Eigenlayer:

- ETH, LST

Networks Supported by Karak:

- Ethereum Mainnet, Arbitrum, K2 L2

Networks Supported by Eigenlayer:

- Ethereum Mainnet only (plans for dual staking may expand network coverage in the future)

Concerning the absence of Stablecoin or other asset types in EL’s restaking options, EL’s CEO, Sreeram Kannan, explained in a talk that:

- EL is designed as a programmable, permissionless platform capable of adapting to accept any token for restaking at any time.

- The initial focus on ETH and related tokens (ETH LSTs) was strategically chosen to capitalize on marketing opportunities and to bolster support within the Ethereum ecosystem.

Challenges

Restaking protocols represent a complex infrastructure, especially when aiming to provide shared security across multi-chains. While crafting a basic staking or restaking contract is straightforward, developing a universal rewarding and slashing mechanism presents significant challenges. Currently, the total value locked (TVL) in restaking is extraordinarily high, yet the development of slashing mechanisms lags behind, and the details of reward systems remain unclear.

At the initial stages, stakers do not receive rewards (with the possible exception of the EL token) when they contribute economic security to a DApp or chain. According to the EL documentation in a FAQ, instead of direct token incentives, EL emphasizes providing a higher level of security to AVS. This foundational security allows AVS projects to develop their products fully before introducing financial incentives. On the other hand, Karak’s documentation does not currently provide details regarding its approach to staker rewards and incentives.

Tech side

The technical aspects also remain somewhat opaque due to ongoing development in asset and network support and the reward/slash mechanisms that are still being finalized. In essence, both EigenLayer and Karak serve as restaking platform providers, with EigenLayer being a pioneer in the industry and Karak expanding the concept to encompass all chains and assets. Below, you’ll find a comparison focused solely on their staking mechanisms.

One note is that Karak introduces a turnkey development systems that strengthen its secure trust networks. This approach may reduce the complexity for DSS developers when using Karak shared security.

Version2 of Polkadot Parachain?

Polkadot stands as a pioneer in the realm of shared security, with Cosmos closely following suit through its design of Interchain Security. Now, the focus shifts to Ethereum, where Eigenlayer (EL) and Karak are forging a shared security protocol. Unlike Polkadot and Cosmos, Ethereum’s restaking protocols don’t establish shared security from within but embrace a similar philosophy to Polkadot’s Parachain system. Imagine translating Polkadot’s Parachain model into EL’s AVS or Karak’s DSS, and Polkadot’s Crowdloan concept into EL and Karak’s restaking mechanisms.

Moreover, Polkadot features more sophisticated systems like Parathreads—projects that utilize shared security under specific conditions—and Coretime, which represents an optimized and dynamic approach to shared security. These innovations are akin to an upgraded version of security offerings in blockchain spaces.

Cosmos was the initial adopter of Polkadot’s shared security model, developing what is known as interchain security. This allows Cosmos to extend shared security to chains based on the CosmosSDK through governance votes, enhanced by features like IBC, ICA, and ICQ, thus enabling easier integration and security for appchains in the Cosmos ecosystem. It’s worth noting that some of EL’s features, including dual staking and aspects of interoperability, draw inspiration from Cosmos’ interchain security.

So, what does this mean for the new restaking protocols in Ethereum? Are they a refined iteration of Polkadot’s Parachain or an advanced version of Cosmos’ interchain security? It appears that Ethereum’s restaking protocols adeptly extract the core principles from both the Polkadot Parachain and Cosmos consumer chain systems, positioning themselves as insightful learners and innovators within the space.

The question that remains is: How well will these protocols perform?

Future Directions in Restaking Development

Restaking is evolving into a new PoS consensus mechanism for DApps and appchains, drawing parallels to traditional staking in PoS systems. Common features between PoS layer1s and restaking protocols include:

- Selection of validators or operators

- Mechanisms for rewards and penalties

- Delegation processes

As we advance in the realm of shared security, we anticipate developments in:

- Dynamic core selling

- Dual staking models

- Enhancements in decentralized and economic security

The path forward is clear, the restaking protocols aim to innovate by dynamically selling security and expanding dual staking models that resonate across multiple blockchain networks. Drawing lessons from the developmental hurdles faced by Polkadot, we can anticipate similar challenges and opportunities for Ethereum’s restaking protocols. However, Ethereum stands out with its substantial Total Value Locked (TVL) and a robust developer community, which are likely to significantly amplify the efficacy and adoption of restaking protocols.

StaFi LRT Stack in LSaaS

To catch up with the trend, StaFi should prioritize the creation of an LRT Stack for Eigenlayer (EL), as well as for Karak and potentially other platforms. StaFi’s LSaaS offers a comprehensive solution for developers looking to create new Liquid Staking Tokens (LST) or Liquid Restaking Tokens (LRT). By developing an LRT stack specifically for EL and Karak, StaFi can significantly expedite the progress of LRT development. With the enormous total value locked (TVL) currently in EL ($15.413 billion) and Karak ($396.96 million), leveraging this TVL through LRT could unlock tremendous market potential and traction. Therefore, it’s strategically beneficial to construct an LRT stack within StaFi’s LSaaS for EL and Karak.