This proposal is from Manta Network to start a Liquid staking for $manta with StaFi

Introduction of Manta:

Manta Network is the modular blockchain for zero-knowledge (ZK) applications. Manta Pacific is the modular L2 ecosystem for EVM-native ZK applications and dApps that want to deliver the lowest cost and best experience for users. Leveraging Manta’s Universal Circuits to enable ZK-as-a-Service and Celestia’s data availability for modularity to deliver low gas fees, Manta Pacific offers the perfect environment for ZK-enabled applications.

Manta Network was created by a team of experienced founders from prestigious institutions, including Harvard, MIT, and Algorand. Manta Network has received investments from many of the top web3 investment funds, including Binance Labs and Polychain Capital. It has grown through participation in the best web3 accelerators, including Alliance DAO and Berkeley Blockchain Xcelerator.

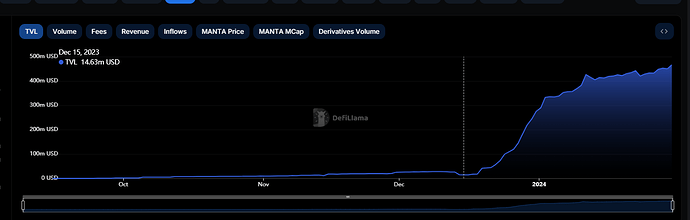

- Manta Pacific is one of the fastest growing Ethereum L2 chains with average growth of 568%.

- With more than 1.71b[+ TVL] (https://dune.com/hashed_official/manta-pacific)

- Manta is 3rd largest L2: https://l2beat.com/

- With over 220+ projects onboarded on Mainnet since September 2023.

- With more than 1m+ community members overall, Manta is one of the largest ecosystems.

Overview of $MANTA and its Use Cases

The total supply of $MANTA at Genesis: 1,000,000,000.

- Governance: $MANTA token holders can vote on network governance decisions on Manta Pacific and Manta Atlantic.

- Staking: Staking $MANTA contributes to the overall security of Manta Atlantic.

- Collator Delegation: $MANTA holders have the option to delegate their holdings with collators or stake $MANTA to run their collators to secure the network.

- Network Fees: Manta Atlantic uses $MANTA to pay transaction fees.

- Native Liquidity & Collateral: $MANTA token can be used in the Manta ecosystem to serve as native liquidity and collateral.

(More details about tokenomics here: (https://mantanetwork.medium.com/manta-tokenomics-b226f911c84c))

Objective:

This proposal aims to outline the potential listing of the innovative rToken - $rManta - on the rLaunchpad program. Additionally, it proposes the creation of the rManta to initiate a liquidity pool and showcase the diverse use cases of the $Manta token within the StaFi and Manta ecosystem.

Proposal to StaFi DAO

-

Initial Liquidity for Manta

The Manta team is happy to provide initial liquidity to bootstrap Liquid staking pool for rManta token. -

Future incentives to drive users

Manta team is happy to involve user engagement with some campaigns which can help to bring users to StaFi and deposit their Manta tokens to get rManta. Apart from the normal staking rewards, we will plan some more incentives for the users so they can be attracted. -

Additional support in future

Based on the TVL after launching rManta, We will provide more support in terms of liquidity and incentives to the users so the growth can be sustained and partnership can be built more strongly. -

Marketing and PR

As Manta is now the third largest L2, we would like to push our partnership strongly to our 1m+ community members and holders of Manta tokens.

Integration on rLaunchpad:

The integration of $Manta on the rLaunchpad program is intended to achieve the following goals:

-

Expand StaFi’s Ecosystem Coverage:

Introducing $Manta extends StaFi’s reach into various ecosystems, enriching its presence in DeFi sectors such as leveraged yield farming, liquid staking, and on-chain derivatives. The adoption of the $Manta token will bring more users to the ecosystem for staking and getting rewards on their holding. -

Enhance rToken Utility:

By incorporating $Manta, we seek to drive higher staking volume and foster capital appreciation for rToken holders, thereby increasing the overall utility of the rToken ecosystem. We will plan some incentives programs so the users will stake $manta to get rManta out of it. -

Boost Community Involvement:

Integration with rLaunchpad features incentivizes community participation, creating an environment that encourages deeper engagement. This initiative aims to attract new community members while strengthening the bond between StaFi and its user base.

Use Case

-

Staking Rewards:

Users staking $Manta in the DAO will be eligible for rewards, fostering active participation and long-term commitment. -

Liquidity Mining:

The DAO will implement a liquidity mining program to incentivize users to contribute liquidity to the $Manta liquidity pool, thereby enhancing the overall liquidity of the token. -

rManta as the collateral in lending market on Manta Pacific

rManta can be used as collateral in lending marketing in Manta ecosystem like LayerBank and shoebill -

rManta can be paired in Dexes

rManta can be paired with $Manta token in DEXes like Quickswap / Aperture / Izumi to have liquidity for users to gain multi-layer of yields

Final Statement

Since its launch in late September 2023, the Total Value Locked (TVL) of the Manta Network has been experiencing rapid growth, with its primary user base coming from 12 regional communities. Currently, Manta boasts a market cap exceeding $929,809,967 and has forged partnerships with more than 400 partners and ecosystem projects. The Current TVL of Manta is $1.7B+ with a share of 8.5% in overall L2 market. The integration of rManta on the rLaunchpad program, coupled with the establishment of the Manta Ecosystem. This represents a strategic move to drive StaFi protocol adoption, enhance community engagement, and provide tangible benefits to rToken holders. We invite the StaFi community to participate in shaping the future of the rManta ecosystem through active involvement in the proposed rManta.