Abstract

This year has been a whirlwind of technical advancements for rETH, including the introduction of withdrawals, integration of DVT through a collaboration with SSV, mobile compatibility, Dune Analytics Dashboard, and more. From a DeFi perspective, rETH has seen numerous DeFi integrations and the recent launch of many Liquidity Pools on prominent DeFi Platforms such as Curve, Balancer, Aura, Pendle, StakeDAO, Convex, KyberSwap (Polygon), Camelot (Arbitrum), Velodrome (Optimism), as well as the launch of a Farming Campaign on the rToken App.

In the fast-paced world of DeFi, new opportunities for growth and innovation are always on the horizon. StaFi is committed to working with DeFi protocols to expand the offerings of rETH, thereby increasing the opportunities and usage of our LSTs for our community. One such opportunity that has presented itself is Yearn Finance’s yETH, a basket of Ethereum Liquid Staking Tokens (LSTs) that is poised to revolutionize Ethereum staking. As StaFi Protocol’s rETH prepares to join this dynamic ecosystem, let’s delve into the benefits that this inclusion will bring to rETH and its users.

yETH: A Potent Platform for Ethereum Staking

Yearn Finance’s yETH is a dynamic user-governed liquidity pool comprising various Ethereum Liquid Staking Derivatives (LSTs); which enables the best risk-adjusted yield from ETH staking. Protocol governance allows users to adjust pool weights for maximizing yield and mitigating risk. By bundling LSTs together, st-yETH aims to generate the best risk-adjusted yield from ETH staking.

StaFi has recently been invited by Yearn Finance to take part in yETH’s whitelisting. By being whitelisted, StaFi will receive the opportunity to incentivize rETH and be voted on by yETH holders and chosen to be included in the final selection of 5 LSTs.

Our proposition is simple, yet profound: we aim to include rETH in Yearn’s yETH Vault. However, this requires the collective will and vote of the community. We encourage all community members to cast their vote in support of this move. Your vote will not just empower rETH, but will also boost your own staking rewards.

The Benefits of rETH’s Inclusion in yETH

Incorporating rETH into yETH offers numerous benefits to the StaFi Ecosystem, Ethereum Stakers on both StaFi and Yearn. yETH’s structure allows for dynamic adjustment of the stake of each LST, optimizing risk and yield among them.

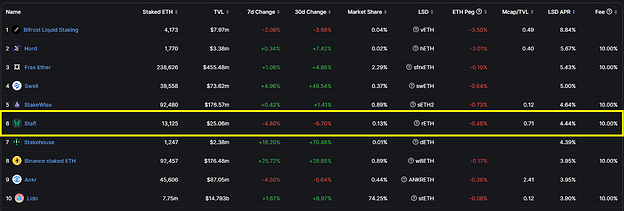

As a high-performing LST with one of the highest APY, closest peg and competitive staking fees, rETH is positioned to be a significant contributor within the yETH basket. Its strong performance should enhance the yield and risk profile of the overall pool.

Source: https://defillama.com/lsd

Benefits:

- Greater visibility: As part of the yETH ecosystem, rETH will reach a broader audience on one of the leading DeFi platforms, encouraging adoption and enhancing rETH’s growth and success.

- Potential growth: rETH’s value and impact in the ecosystem will grow proportionately with the overall deposited ETH on Yearn Finance, leading to an expected increase in its market share.

- Higher APY: Staking with yETH and voting for rETH provides participants with an elevated Annual Percentage Yield (APY) due to additional incentives from the LSTs in the yETH basket. As more LST protocols, like StaFi, offer incentives, APY for users staking their ETH via yETH can significantly rise.

- Deeper liquidity: Integrating yETH may potentially lead to improved liquidity for rETH, making it easier for users to trade their tokens.

- Risk Diversification: By being a part of the yETH staking pool, Ethereum stakers can spread their risk across multiple LSTs, increasing the overall safety of their investment.

Get Started With yETH & Vote for rETH

StaFi’s rETH has been whitelisted on yETH, paving the way to be included in the basket of LST’s. Your vote for rETH is more than just backing StaFi - it’s an opportunity to shape the staking future of Ethereum. Thanks to yETH, you can cast your vote without any strategic limitations. In appreciation of your support, we promise added incentives on top of the regular Ethereum Staking Rewards if rETH makes it into yETH’s LST Basket. This leads to a double win - greater rewards for you, and a flourishing ecosystem for rETH. Let’s aim for new horizons in Ethereum staking. Cast your vote for rETH.

Participate by following these steps:

1.Deposit ETH and receive yETH

Closing Date: 12pm UTC, 31st July 2023

Head over to https://yeth.yearn.finance/deposit and deposit your ETH to receive an equivalent amount of yETH. Please bear in mind, your tokens will be held for a specified period.

2.Vote for rETH

Date: 12pm UTC, 28th July - 12pm UTC, 4th August 2023

Visit https://yeth.yearn.finance/vote to vote for rETH as soon as voting goes live on Yearn Finance. Supporting rETH amplifies your staking APY while benefiting the overall staking ecosystem!

Your Voice Matters

As we embark on this exciting journey, we want to hear from you. Which platforms or protocols do you hope we can integrate rToken with? Your insights can help shape the future of StaFi and rETH. So, let’s start the conversation. Let’s build a better staking ecosystem together.

In conclusion, the inclusion of StaFi in the yETH ecosystem marks a significant milestone for rETH. It’s an opportunity to increase visibility, drive growth, and enhance APY for users. But this is just the beginning. With your support and our commitment to innovation, we’re confident that the best is yet to come for rETH and StaFi. So, let’s embrace this opportunity and shape the future of DeFi together.