To the StaFi Community and rLaunchpad Committee:

This proposal outlines the potential listing of one innovative rTokens - rASTR - on the rLaunchpad program to foster community engagement and drive StaFi protocol adoption. By integrating these promising DeFi projects within the rLaunchpad ecosystem, we aim to:

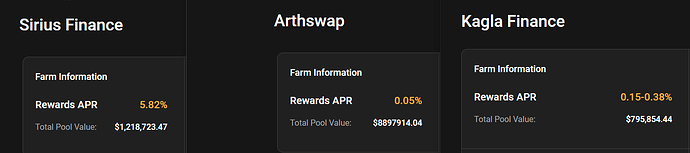

- Expand StaFi’s Eco Coverage: Offering rASTR expands StaFi’s reach into diverse ecosystems and its DeFi sectors, including leveraged yield farming, liquid staking, and on-chain derivatives.

- Enhance rToken utility: Drive higher staking volume and capital appreciation for rToken holders.

- Enhance Community Involvement: Integrating these projects incentivizes community participation through rLaunchpad features. This fosters deeper engagement, attracts new community members, and strengthens the bond between StaFi and our community.

Ecosystem Comparison:

Astar Network(ASTR):

Astar Network is Japan’s most popular smart contract platform, supporting both EVM and WebAssembly (Wasm) environments, and interoperability between them using a Cross-Virtual Machine. Astar Network is friendly to all kinds of developers, and the tools and languages they already know. Backed by the shared security of Polkadot, Astar shines brilliantly on its own within a vibrant and healthy ecosystem, and in the blockchain industry overall driving international corporate adoption, and consumer interest in Web3 technologies. Astar is a blockchain connected to Polkadot Relay chain, specialized for Executing all types of smart contracts ,Providing a hybrid EVM + Wasm environment supporting Cross-VM (XVM) smart contract calls, Incentivizing ecosystem innovation and providing basic income for dApp developers and seamlessly aggregating features or assets from parachains in the ecosystem.

- ASTR: 5.4b+ circulating at 88.3% already, with an uncapped maximum supply.

- TVL: ~$55 million

- Recent growth: ~238% growth in TVL since October lows at $23.4 million.

- Adoption: Strong adoption by Japanese DeFi users as due to major partnerships in japan such as a partnering with a Japanese telecom Firm KDDI which to explore opportunities and accelerate the growth of blockchains to enhance customer experience.

- Recent News: Astar restructuring their tokenomics, Astar Tokenomics 2.0

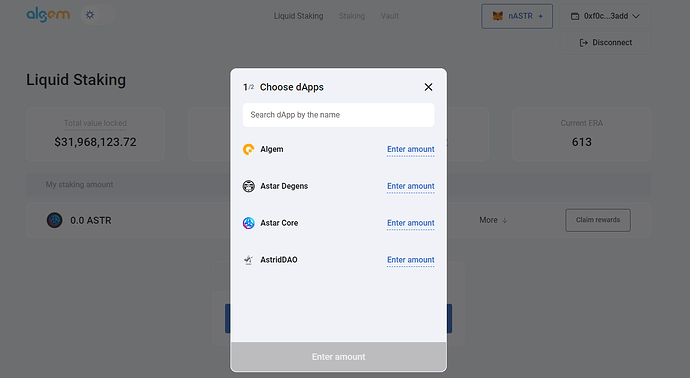

![]() Pick Reason:

Pick Reason:

Since its launch in January 2023, the Total Value Locked (TVL) of the Astar Network has been experiencing rapid growth, with its primary user base being Japanese, in contrast to other chains, predominantly in the EU and NA regions. Currently, Astar boasts a market cap exceeding $700 million and has forged partnerships with significant enterprises in Japan, collaborating closely with Japan’s government. Positioned strategically, Astar has the potential to emerge as a leading contender among blockchain networks, particularly given Japan’s widespread popularity and with Japan ranking as the world’s third-largest economy after NA and China, Astar stands to capture a substantial amount of capital, leveraging its status as a trusted blockchain platform in the Japanese market. And with Astar Network building as well their own zkEVM, In summary, zkEVM chains provide advancements in scalability, privacy, security, interoperability, environmental impact, user experience, cost efficiency, and governance compared to non-zkEVM chains, making them an attractive choice for developers and users in the blockchain space.